OneCard Credit Card Statement: A Complete Guide

By OneCard | June 21, 2021

Every month, we put together details of all the monthly spends on your OneCard, as well as those hundreds of reward points you’ve earned, into a statement that we can present to you in a simplified manner. Hope you’ve checked your latest statement.

Table of contents:

Your OneCard Credit Card Statement

Your statement shows you all your spends for the month as well as credits (such as refunds, chargebacks) and more.

The statement date and payment due dates vary across banks that issue OneCard, and you can find the dates applicable to you in the Profile section in the OneCard app.

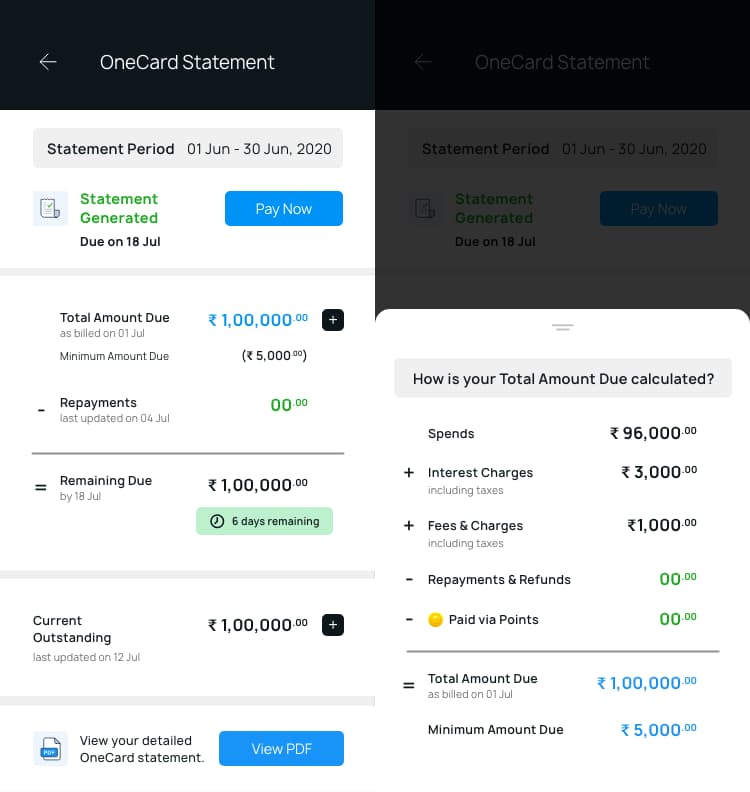

You can view your card statement in the app and some of the key items to look out for are:

Total Amount Due (TAD): the total amount due on your card when the statement is generated.

Minimum Amount Due (MAD): this is the amount you must pay by the payment due date to keep your card account in good standing

Payment Due Date: the date by when payment must be done. You can also choose to pay a custom amount that is more than the Minimum Amount Due and lesser than Total Amount Due

Interest Charges: the amount that is charged on the unpaid amount from the previous statement as well as any on new spends in the current statement

Fees & Charges: these refer to fees levied separately such as Late Payment Fee, Over Limit Fee, or Forex Fee (on your foreign currency transactions), and includes GST and other taxes as applicable

Repayments & Refunds: any repayments you make during this period are shown here, and reduced from your outstanding dues. Amounts received as refund or chargeback are also mentioned here

Paid via Points: you can repay your purchases using the reward points you’ve earned. Once you accumulate enough points, just swipe on a purchase from the app home screen to repay it, and the redemption amount is displayed here. You can also do this from the Rewards tab. Tap on the “Redeem” button to view eligible transactions and swipe right to redeem that purchase.

ALSO READ: Understand Your Bill Repayment of OneCard Credit Card

Get Statement as a PDF

A PDF statement makes it super easy to submit while claiming any reimbursement or even for sharing with your Chartered Accountant. Instead of searching your email inbox, just tap on “View PDF” to view your statement in PDF format in the app. You can download it from your phone if needed.

Transparent and Daily Interest Calculation

Besides details of spends and credits, the statement also contains information about interest levied (if applicable). We calculate interest daily and this helps you in making the payment with lesser charges without waiting till the next statement is generated. Here’s a detailed post on how interest is charged on your OneCard.

However, you should keep in mind that if you have previously outstanding dues, you would already be paying interest on those.

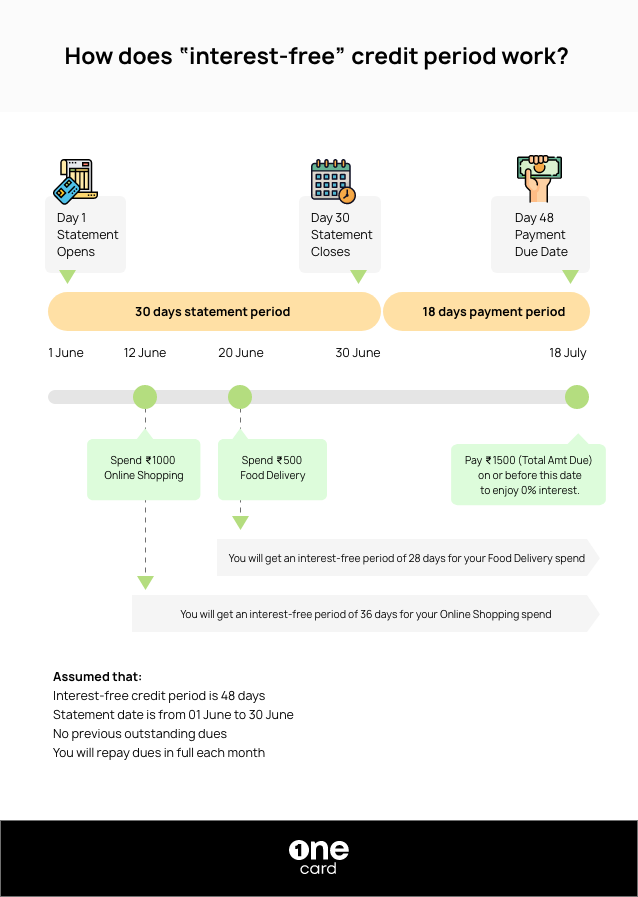

How Interest-Free Credit Period Works On Your OneCard Credit Card

When you make a purchase and have no previous outstanding dues, you get an interest-free credit period, depending on your date of purchase.

ProTip: If you typically make the full payment each month, the best time for a fresh purchase is once you get your statement - this would give you an interest-free period of 48 days.

Pay Your OneCard Bill Directly From the App

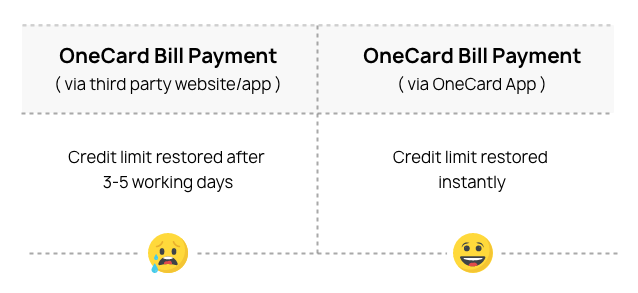

The icing on the cake - if you make the payment from the OneCard app, your credit limit equivalent to that amount is restored immediately! Isn’t that awesome? 😎

No need to wait for 3-5 days after paying from a third-party website or app. Just make the payment from the OneCard app via UPI, Debit Card, or Netbanking, as per your convenience.

We have recently added an option to pay via bank transfer. Scroll to the end of the statement section in your app and tap on “Details”. You can view the OneCard bank account number and IFSC to which payment can be done via IMPS or NEFT.

Remember: If you pay at least the Minimum Amount Due by the payment due date,

- it helps to avoid late payment charges. - it ensures that your card account remains in good standing

Of course, if you pay the Total Amount Due by the payment due date, you avoid paying interest charges too. Win-Win!

**Disclaimer: The information provided in this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Technologies Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader for making any decision based on the contents and information. Please consult your advisor before making any decision.

Sharing is caring 😉