Goods and Service Tax is applicable on all fees, interest and other charges

**Illustration on Interest Free (grace) period

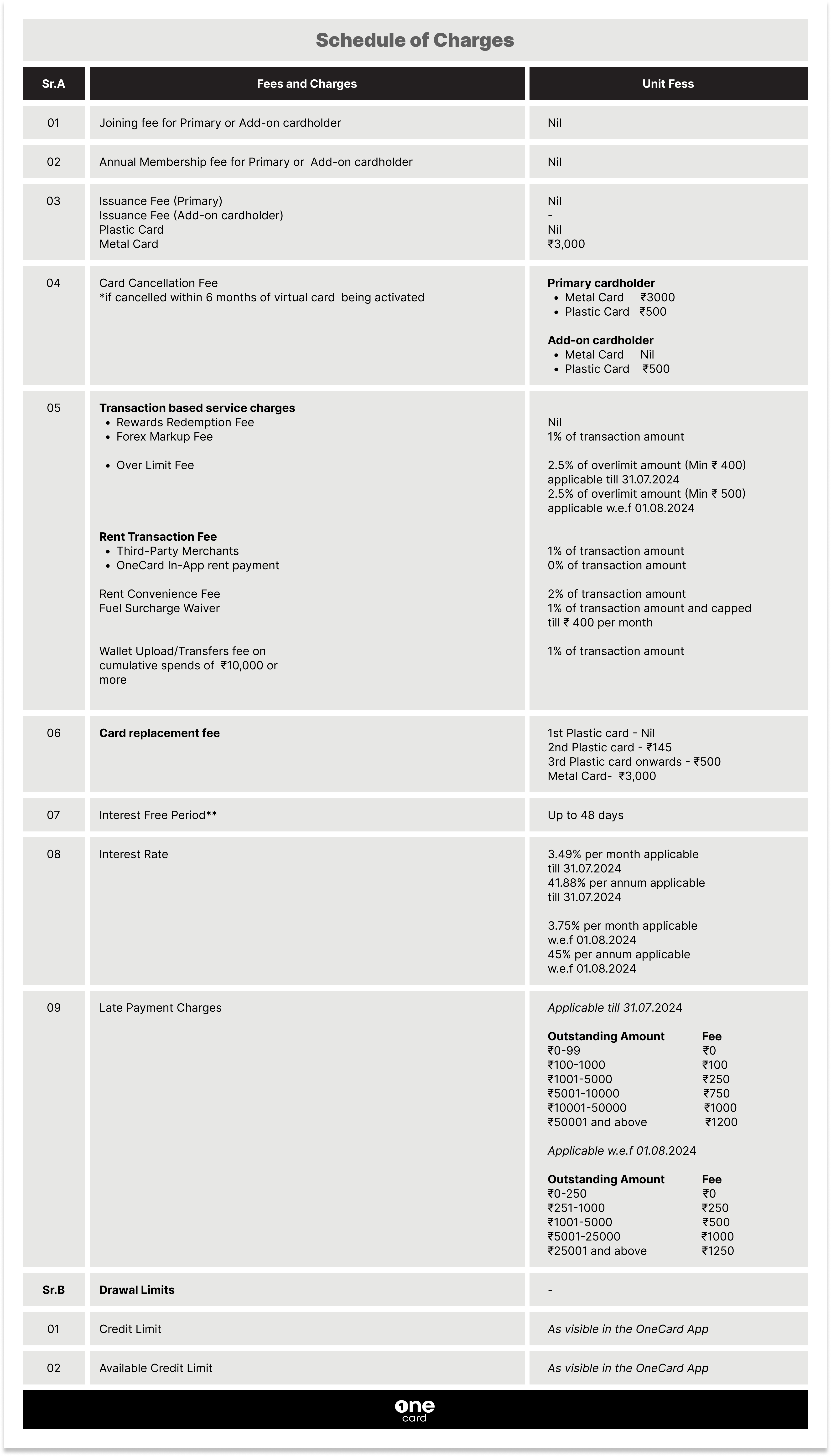

Interest free period will not be available if you have not paid the previous month’s outstanding amount in entirety. Interest free period from the start of the billing cycle date shall not exceed 48 Days. Payment Due Date on your Card is 18 days after the Statement Date (Please check your statement for your exact Payment Due Date). Therefore free credit period can range from 18-48 days depending on your Payment Due Date.

Illustrative Example for Interest Free Period Calculation:

For a statement for the period 14th April to 13th May, the payment due date is 1st June. Assuming you have paid Your previous month’s dues in full, the interest free period would be: For the purchase dated 14th April, interest free grace period is from 14th April to 31st May = 48 days and for the purchase dated 2nd May, interest free grace period is from 2nd May to 31st May = 30 days.

Billing Statement: Your billing statement will be generated every month (bill date is visible in the app and can also be changed once from the profile section of the app as per your convenience). It will contain a break-up of all purchases, repayments, fees, interest charges, refunds and taxes. In case the card was not used in a month, the statement will mention there were no spends in that month.

Mode of sending statement: The billing statement will be shared over email, on a monthly basis to you, and will also be available on your OneCard app.

***Minimum Amount Due: When you get your Federal Bank One Co-Branded Credit Card statement, you can choose to pay the full amount (Total Amount Due) or pay just 5% of the Total Amount Due. This is known as Minimum Amount Due (MAD), and at least this amount must be paid before the Payment Due Date (currently on 1st or 2nd). The remaining balance can be carried forward to subsequent months. This Minimum Amount Due will be:

i) 5% of the outstanding amount or ₹100 (whichever is greater) PLUS ii) Total sum of any card fee, overdue minimum payment iii) Any amount exceeding the credit limit iv) Entire amount of any instalments (EMI) due (if/as applicable)

You can also pay the Total Amount Due or an amount between the Minimum Amount Due and Total Amount Due.

Method of payment

You can pay the outstanding dues from the App itself, through the following modes: Debit Card b) Netbanking c) UPI d) IMPS/NEFT to unique Federal Bank One Co-Branded Credit Card account number provided in app.

Billing Disputes Resolution : In case of any query or a dispute on any transaction, you must inform us within 30 days of receipt of the statement, by using any of the contact particulars stated below. We will assist you by providing information in relation to charges to the card account. A temporary suspension would be applied on the disputed transaction while under investigation. This would be resolved within a maximum of 60 days.

Complete Postal Address of card issuer: The Federal Bank Ltd, 2nd Floor, Parackal Towers, Federal Bank, Operations Department, Parur Junction, Aluva, Ernakulam, Kerala, India, 683 102

Grievance Resolution

- In-app Chat support through OneCard App: The customer can chat with an agent in the Mobile App provided to the customers or call the customer care number.

- Email to help@getonecard.app or call to help line no: 1800-210-9111.

- Email to contact@federalbank.co.in

- Email to grievances@fplabs.tech.

- Write to Federal Bank, Fintech Partnership Department, Kerala Technology Innovation Zone, Kinfra Hi-Tech Park Main Rd, HMT Colony, P.O, Kalamassery, Kochi, Kerala 683503

- Escalate to the Nodal Officer of the Bank by sending Email to support@federalbank.co.in

- Escalate to the RBI Ombudsman by visiting the RBI website at https://www.rbi.org.in/