These Terms and Conditions (Terms) apply to OneCard Credit Card (OneCard) issued by various banks (Bank) and managed by FPL Technologies Private Limited (FPL). Availing of EMI facility on your OneCard would mean acceptance of the below terms and conditions by the Cardholder/Cardmember (You).

These Terms presently in force were last updated on September 13, 2021 and are subject to changes from time to time. The most recent version will always be available on this website. We will notify you of any changes in charges.

-

Definitions and Interpretation

1.1 “Cardmember/Cardholder” means an individual who has been issued the OneCard credit card.

1.2. “Credit Limit” means the limit up to which a Cardmember is authorised to use the OneCard credit card for a purchase transaction at an online/offline merchant establishment.

1.3. “Customer Care” refers to customer service and support systems provided by FPL Technologies Private Limited.

1.4. “Minimum Amount Due” or “MAD” means the amount mentioned in the OneCard credit card statement, which is the minimum payment a Cardmember must make by the payment due date to keep the card account in good standing.

1.5. “Total Amount Due” or “TAD” means the amount mentioned in the OneCard credit card statement, which is the total amount due for payment when the statement is generated.

1.6. “Equated Monthly Instalment (EMI)” shall mean facility wherein purchase(s) instalments at a rate as communicated at the time of availing the EMI. EMI debited would include the Principal + Interest + applicable Goods & Services Tax (GST).

The present Terms are to be read in conjunction with, and not in derogation of, the OneCard Credit Card Most Important Terms and Conditions (“MITC”)as well as the OneCard Credit Card Terms and Conditions (“T&C”) and nothing contained herein shall prejudice or affect the clauses of the MITC and T&C. Unless otherwise specified, the words and expressions used herein shall have the same meaning as in the MITC and T&C.

-

Eligibility for EMI Facility

2.1. The EMI facility is open to select Cardmembers. FPL/Bank reserves the right to decide the eligibility as per internal policy and guidelines.

2.2. Cardmembers can convert settled and unbilled purchases of Rs. 2,500 (Rupees Two Thousand Five Hundred) and above into EMI.

2.3. FPL/Bank reserves its absolute right and discretion to approve or decline any request for EMI. It is further clarified that transactions under certain merchant categories especially gold, jewellery, ATM transactions, cash transfer, fuel, etc. related transactions or any other transactions prohibited under law cannot be converted into EMI.

2.4. When you make a purchase under EMI, the available Credit Limit on your OneCard credit card account shall be reduced by an amount equal to the principal but your account statement for any month will reflect only the instalment amount due from you for that EMI transaction during that month.

2.5. Only the complete charge/transaction amounts are eligible for the EMI and any requests for part of the charge or clubbing of multiple charges into EMI are not allowed.

2.6. Existing outstanding balances from transactions already converted into EMI, cannot be converted into EMI.

2.7. Cardmembers can, at any point in time, avail any number of transactions for conversion into EMI, subject to availability of Credit Limit and above conditions.

-

Interest, Charges, and Instalments

3.1. The interest charges on EMI transactions are charged at a rate communicated to the Cardmember at the time of availing of the facility and on a monthly reducing balance. We reserve the right to change the offered EMI interest rate from time to time and furthermore, reserve the right to simultaneously offer different EMI interest rates for purchases and different items that differ based upon communication channel, media and merchant.

3.2. Any change in the EMI interest rate shall not affect EMI transactions already getting billed on the card prior to the effective date of that change.

3.3. Once the EMI tenure has been chosen by the Cardmember, it cannot be changed.

3.4. For transactions converted into EMI post purchase, the interest rate would be communicated at the time of conversion. Additionally, there would be a processing fee of 1% on the transaction amount (min of Rs.99) + GST as applicable. A foreclosure charge of 3% on the remaining principal amount (min of Rs.99) + GST as applicable will be charged if closed before the chosen tenure.

3.5. GST will be applicable on processing fee, interest and foreclosure charges and is subject to change as per relevant regulations of the Government of India.

3.6. The Credit Limit on the Credit Card shall be blocked to the extent of the full transaction amount. The Credit Limit will be released as and when the EMI is billed and paid for in subsequent months.

3.7. Fees and charges once posted to the Cardmember’s account during the EMI conversion and EMI foreclosure shall not be waived off for the Cardmember in any scenario.

-

Billing and Prepayment

4.1. The interest component for the first instalment shall be computed from the EMI booking date. For all the instalments, the interest shall be computed on a monthly basis and the instalment shall be added to the MAD on the date of each monthly bill.

4.2. After processing Cardmember’s request for conversion of transactions into EMI, the amount shall be billed on the first statement for the OneCard that is generated post the conversion of the transaction into EMI.

4.3. The instalment amount for each EMI shall be paid in full each month, notwithstanding the minimum monthly payment requirements stipulated in the MITC and T&C. The aggregate of all EMI instalment amounts for any billing period will be added to the minimum monthly payment calculated for all other charges or outstanding balances for that billing period. We reserve the right to charge default interest on any unpaid or partially paid instalment amount.

4.4. Any amount in excess of Cardmember’s full outstanding balance reflected in current statement will result in a credit balance lying in Cardmember’s card account and will not be applied to unbilled EMI instalment amounts.

4.5. Notwithstanding anything stated elsewhere, FPL/Bank at its sole discretion reserves the right to off-set any credit balance on the card account against any due EMI instalment.

4.6. In case of full refund from the merchant, the Cardmember should contact our Customer Care team and place a request for EMI cancellation.

4.7. FPL reserves the right to levy late payment fees and default interest (2.5% p.m + GST) on any unpaid or partially paid instalment amount.

-

Schedule of Repayment

5.1. While creating the schedule, 30 days (year of 360 days) will be considered for a month’s interest and based on the calculation, the entire schedule will be created.

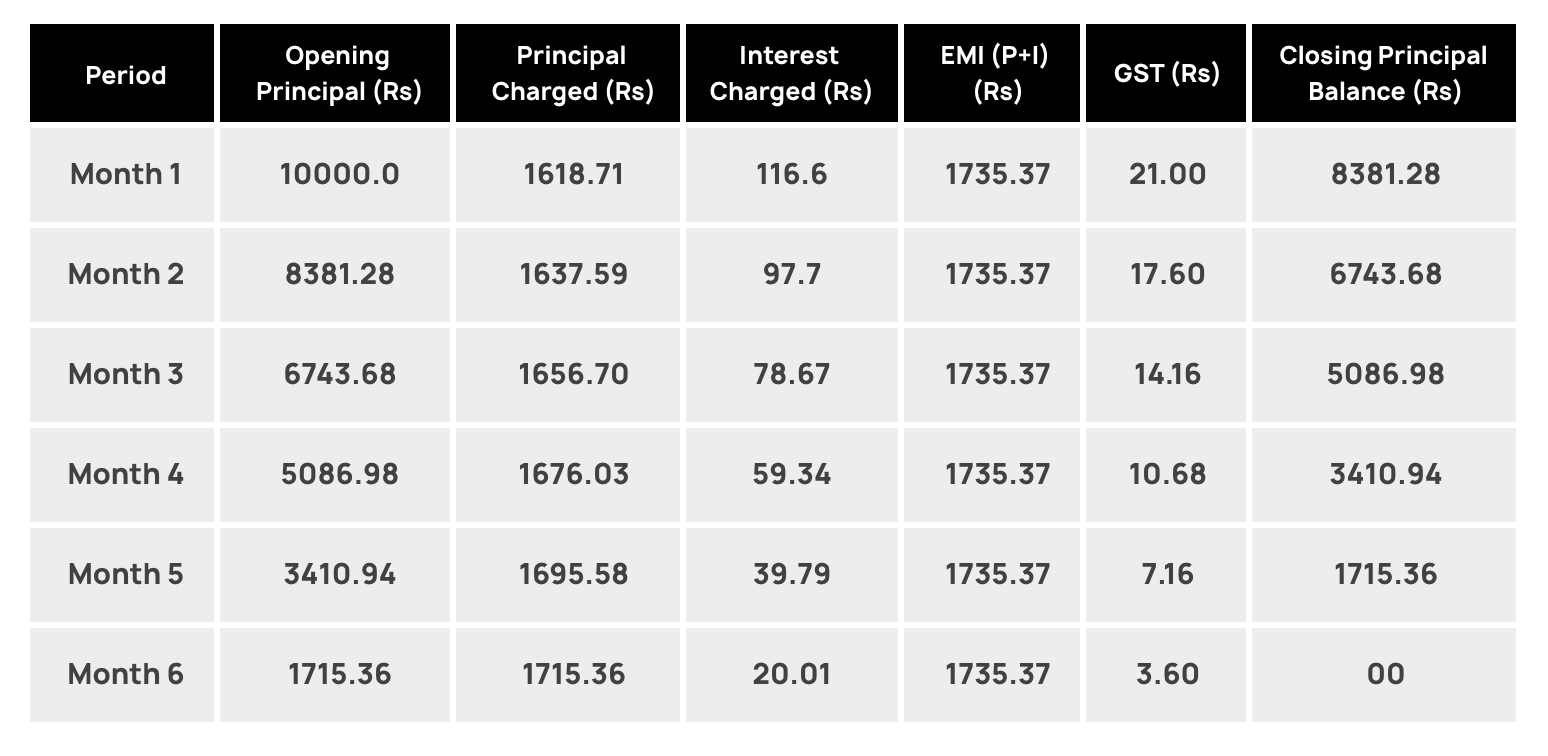

5.2. Example:

Principal = Rs. 10,000, Tenure = 6 months, Interest rate = 1.33% p.m, GST = 18% of the interest component

-

Cancellation/foreclosure of EMI facility

6.1. Cardmembers may foreclose the aggregate of all unbilled principal in full only by opting for foreclosure by calling Customer Care or from the EMI dashboard in the OneCard app (will be available soon).

6.2. Upon foreclosure, the entire outstanding amount will be billed to the Cardmember’s account statement. If the Cardmember has carried forward balance at the time of foreclosure, the entire amount will attract applicable OneCard interest rate as specified in the monthly Statement of Account else the amount will be due for payment as per billing cycle.

6.3. Upon foreclosure, the entire outstanding amount along with the upcoming month’s interest (only if the EMI has been posted to Cardmember’s account) will be billed to the Cardmember’s account statement as a part of the Total Amount Due. If the Cardmember chooses not to pay the entire amount and opts to carry forward a balance, the entire amount will attract applicable OneCard interest rate.

6.4. In the event the OneCard account remains past due for more than ninety (90) days (due to non-payment of Minimum Amount Due), the EMI shall be foreclosed with the principal outstanding along with the upcoming month’s interest (only if the EMI has been posted to Cardmember’s account), billed to the OneCard account. FPL shall be entitled to demand immediate repayment of such outstanding amounts as deemed appropriate.

6.5. In the event the OneCard is blocked or closed prior to all EMI(s) being charged, the EMI(s) shall still continue to be billed in the monthly statement and shall be included as a part of the Minimum Amount Due. However, in the event the OneCard remains past due for more than ninety (90) days, the EMI shall be foreclosed as stated above.

6.6. If the Cardmember does not renew the card, in the event the period of the card expires during the tenure of the EMI facility, FPL shall be entitled to debit the Cardmember’s OneCard account up to ninety (90) days of no payment.

6.7. In case of card renewal/upgrade, if the new card is out for delivery and undelivered which leads to deactivation/cancellation, the EMI account will be closed and the Cardmember will be liable to pay the complete outstanding as per the statement with the foreclosure and associated charges.

-

Merchant EMI

7.1. The processing of conversion of a transaction into Merchant EMI shall take up to 2-8 business days from the date of transaction. FPL/Bank reserves the right to accept or reject EMI requests.

7.2. Interest subventions/waivers (if applicable and communicated to cardmember at the time of the transaction) for an EMI transaction shall be credited to the cardmember in up to 90 business days.

7.3. The minimum value of the credit transaction should be Rs. 2,500 or more to be eligible for conversion of transaction to Merchant EMI.

7.4. Merchant EMI facility is available at select stores and brands only.