What is Credit Card Skimming and How to Avoid It?

By OneCard | November 24, 2021

Credit card technology has evolved over the years, and while this evolution has been remarkable, fraudsters have managed to keep up with this pace to steal information using various tactics. One such tactic is skimming.

Table of contents:

So, what exactly is skimming?

It is the act of illegally copying your data from the magnetic stripe of a credit or debit card. It’s usually done using methods such as photocopying receipts or more advanced ways like using a small electronic device called a skimmer to swipe and store hundreds of credit card numbers. Skimming can be done at even your usual places like restaurants, hotels, retail counters, fuel pumps, etc.

Is there a way to prevent my card from getting skimmed?

While most of us try to stay on top of our game when it comes to credit card security, there are still a few things that tend to go unattended on a daily basis. While some of the ways might seem way too common to you, keeping them in mind and working on them is as important as it can get.

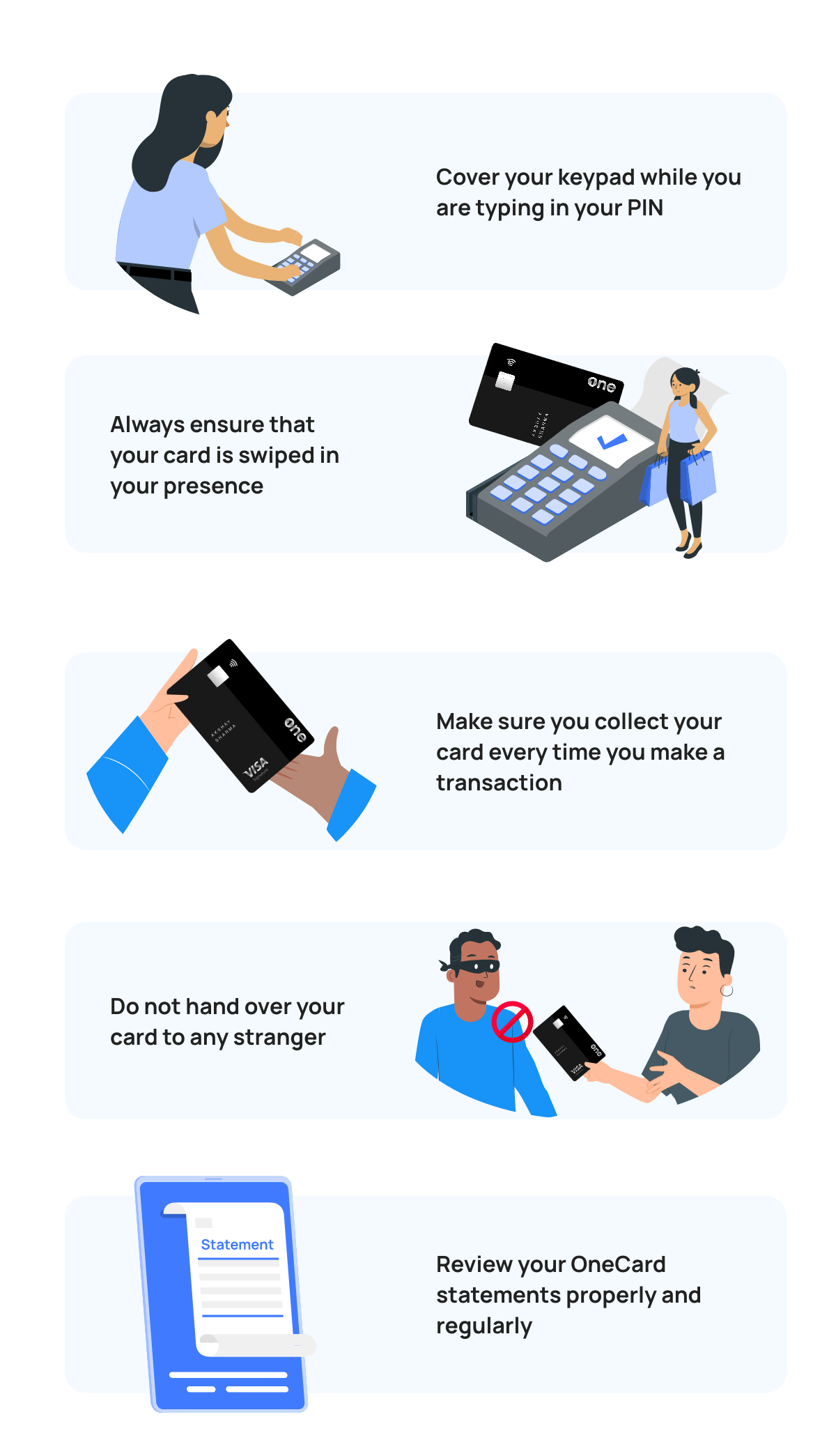

- Cover your keypad while you are typing in your PIN. Use your hand and body to cover your keypad when operating a handheld PIN pad or a payment processing machine/Point Of Sale Device. This will prevent shoulder surfers and pinhole cameras from knowing your PIN.

- Always ensure that your card is swiped in your presence. Get up and go to the machine instead of giving your card to a waiter/attendant for payment processing at restaurants, movie theatres, retail stores, fuel stations, etc.

- Make sure you collect your card every time you make a transaction. So, the next time you are sipping your favourite coffee, remember to collect your card after clearing the bill.

- No credit card issuer or card company asks for your physical card. Hence, do not hand over your card to anyone including those claiming to be company representatives.

- Review your OneCard statements properly and regularly. If you ever observe a transaction that has not been made by you or is suspicious, report the same to our helpline immediately.

Always remember: OneCard will never call and ask you for your PIN, CVV number or any other sensitive details.

In case you do get a call from OneCard asking for the same, immediately reach out to us at reportfraud@getonecard.app. If you have already been targeted by a fraudster or hacker, here are a few steps for immediate damage control:

- Immediately block your card from the MyControls section of your OneCard app

- Contact our Customer Support via chat or write to us at reportfraud@getonecard.app

- Lodge a complaint with the nearest Cyber Crime Police Station / National Cyber Crime Reporting Portal at cybercrime.gov.in or call on helpline number 1930

You can avoid falling into such traps by staying aware and taking the right steps.

**Disclaimer: The information provided in this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Technologies Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader for making any decision based on the contents and information. Please consult your advisor before making any decision.

Sharing is caring 😉