How Will the New TCS Impact Your Credit Card Spends

By OneCard | June 23, 2023

Foreign travel is a dream of many, but it can be challenging to manage finances while traveling. Credit cards are one way to simplify it as they come with various travel offers, better security, and the convenience of making payments.

However, a recent announcement by the Ministry of Finance caused discomfort among many Indians aspiring to travel abroad. On May 16, 2023, the Ministry of Finance announced the applicability of TCS (Tax Collected at Source) on international credit card usage and other such changes that will come into effect on July 01, 2023. Let’s look at what it is all about.

Table of contents:

What Is TCS and What Are the Changes in It

TCS was first introduced in 2020 to be charged on foreign remittances made under the Liberalised Remittance Scheme (LRS) including activities such as foreign travel, the purchase of assets, and medical and educational expenditures. LRS is a foreign exchange policy that was introduced by the Reserve Bank of India in 2004 making remitting funds outside India simpler for resident Indians.

Following are the changes introduced on May 16, 2023, with respect to TCS:

-

International credit card spending will now come under the Liberalised Remittance Scheme (LRS). Due to this, credit card spending in a foreign currency will now be a part of LRS’s limit of USD 2,50,000 spends per person in a financial year (INR 2,06,84,375 as per the current exchange rate). This spending will also be subject to tax collected at source (TCS).

However, due to public discontent, the Ministry of Finance, announced on May 19, 2023, that any payments by an individual using their international Debit or Credit cards up to Rs. 7 lacs per financial year will be excluded from the LRS limits and hence will not attract any TCS.

-

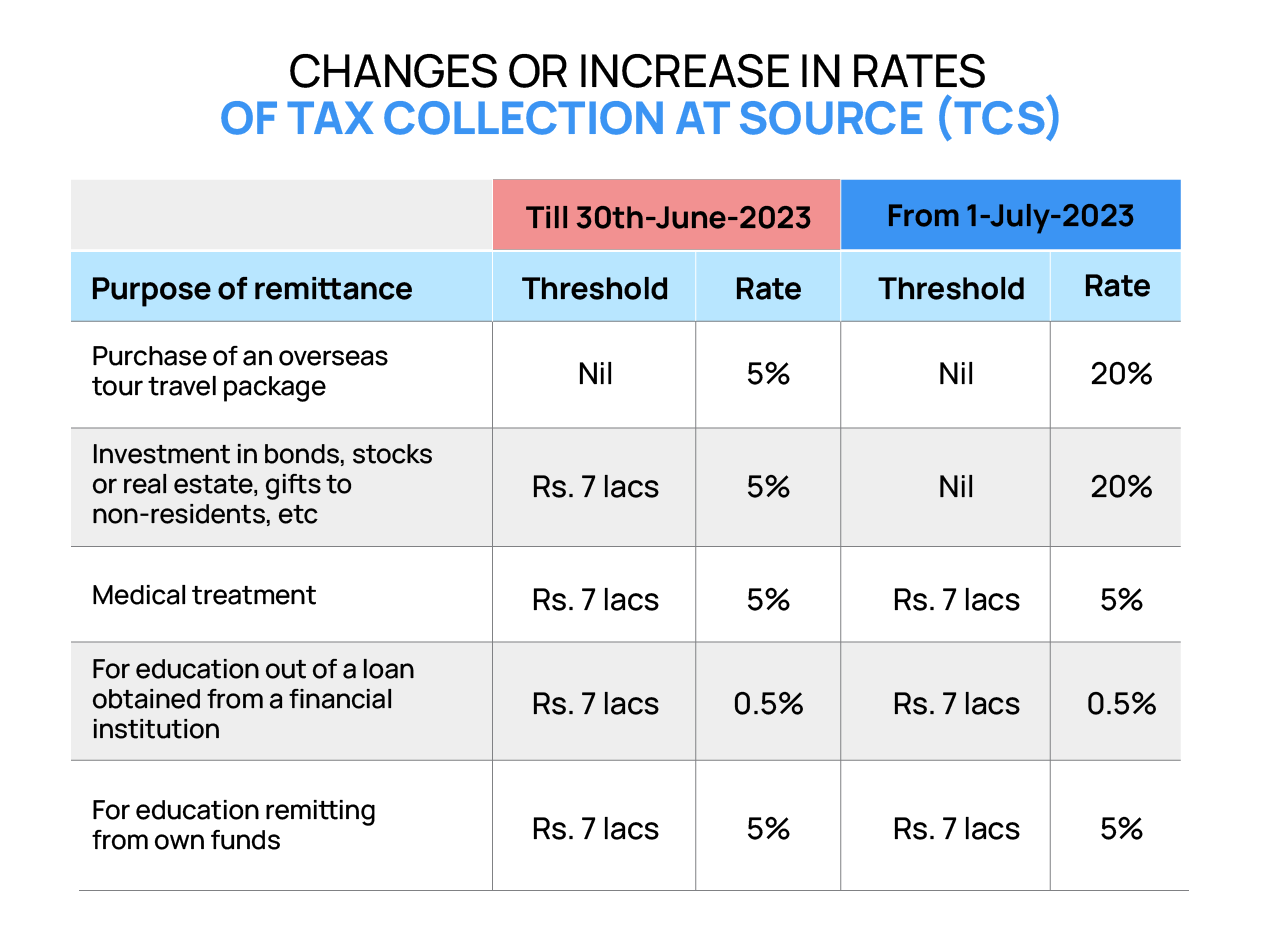

The rate of TCS has been changed to 20% in certain categories. Check out more details in the table below.

-

Certain spending thresholds that existed until now have been removed, while some thresholds, such as those for educational and medical expenditures, continue to remain as per the table shown below.

How Does TCS Work

TCS is not a final tax, i.e., it can be claimed as a refund if your total annual income is not taxable. And, if you are a taxpayer, the TCS deducted can be adjusted against your total income tax liability at the end of the year.

Thus, TCS can be adjusted against any of the following:

- TDS deducted by an employer

- Advance tax on a quarterly basis

- Self-assessment payments

- Final income tax payable

How Does the Increased TCS Impact the General Population

The major concern around TCS was its applicability to international credit card usage. However, the Ministry of Finance took note of it and exempted expenditures up to INR 7 lacs from TCS. However, TCS can still impact you in the following ways:

You need to plan for an additional 20% spending

For those transactions where TCS is applicable, people must account for 20% extra money. This may restrict the amount of cash available to them.

For example, if you have planned a family trip abroad and your credit card spending budget exceeds INR 7 lacs, you will have to account for the 20% TCS on the amount spent above INR 7 lacs and wait a few months to claim it back.

There is a possibility of improved tax compliance

There is a hope that implementing TCS on credit cards will increase tax compliance in India. This is because if someone has not been filing tax returns previously, they will have to do so now to claim credit for the TCS paid on overseas transactions using credit cards.

ALSO READ: How to Use Your Credit Card to Save Tax?

FAQs

1. Is TCS applicable on debit cards, foreign currency, and forex cards?

International spending made via debit cards comes under LRS, and hence TCS is applicable as per the thresholds and rates of TCS for the respective categories. Experts are still seeking clarity regarding the applicability of TCS to foreign currency and forex cards.

2. When will the new TCS rules come into effect?

The new rates and rules of TCS will come into effect from July 01, 2023.

3. Will TCS be refunded if I cancel my international bookings?

TCS will not be refunded if you cancel your international bookings. However, it can be claimed back while filing your ITR.

4. Will TCS be applicable for an overseas tour package purchased through an Indian tour operator?

Yes, TCS is currently applicable at 5% on purchases of overseas tour packages. The rate of TCS will increase to 20% with effect from July 1, 2023.

5. Is TCS applicable to international business expenses?

If an employee uses a corporate credit card, it will not attract TCS for an international transaction made in a foreign currency. However, clarity is awaited on whether purchases done via personal credit cards on business trips will be exempt from TCS or not.

6. Is TCS applicable on the purchase of foreign subscriptions?

Yes, TCS will be applicable if you pay online in dollars or in an international currency for shopping on a foreign website or while paying for an international subscription using your credit card.

7. Who deducts the TCS?

When a sale happens, TCS is collected by the seller from the buyer to be deposited with the tax authorities. However, in the case of credit cards, it will be collected by the credit card issuer, or an authorised dealer, or a bank.

**Disclaimer: The information provided in this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Technologies Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader for making any decision based on the contents and information. Please consult your advisor before making any decision.

Sharing is caring 😉