Everything you need to know about FD backed OneCard

By OneCard | November 24, 2023

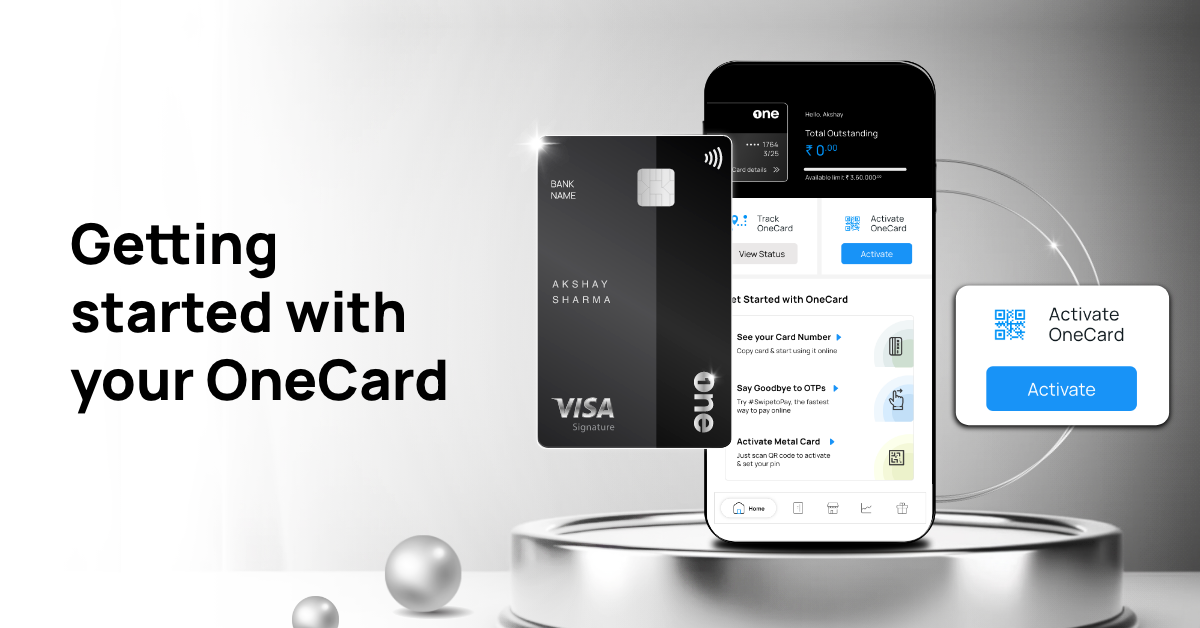

If you have never used a credit card before, it can be tough to get one. The only options you may then have is either to choose a credit card that comes with your salary account or go for an add-on card from your immediate family member’s account. However, if you want to get your own credit card that is also stylish and convenient, you can opt for an FD backed OneCard.

Here’s all you need to know about the FD backed OneCard:

What is FD backed OneCard

An FD backed OneCard is just like a regular OneCard. The only difference is that you need to create a Fixed Deposit with our partner bank that earns you interest while you use your card. You can create an FD starting at as low as Rs. 5,000 and up to Rs. 1,00,000. If you want to get a metal card, you need to create an FD of at least Rs. 50,000.

Which banks issue the FD for OneCard

Your FD will be created with the same bank that issues your credit limit. Currently, we offer FD backed credit cards in partnership with SBM and Federal banks, both of which are RBI approved banks. You will earn an attractive interest rate of 7.5%* on your FD from these banks.

How to make the most of FD backed OneCard

An FD backed OneCard is just like any other OneCard. The only difference is that you can earn attractive interest on your FD while enjoying the benefits of your card. However, if you are new to credit cards or have a low credit score, the FD backed OneCard will be your best bet to increase your credit score. Here’s how you can do it:

1. Make timely repayments

Based on your billing cycle, you will have a due date to repay your dues. The best way to go about it is to pay the full dues before the due date. If, in any case, you are not able to pay the full dues, you should at least pay the minimum amount due before the due date so that your credit score is not affected. If you are unable to pay your full dues, you can make use of the Bill to EMI option and protect your credit score.

If you are busy all the time and tend to forget important deadlines, you can also set up Auto Pay for your OneCard bill. You can pay either the minimum amount due or the total amount due at a certain date before the due date every month.

ALSO READ: Understand OneCard Credit Card Bill Repayment

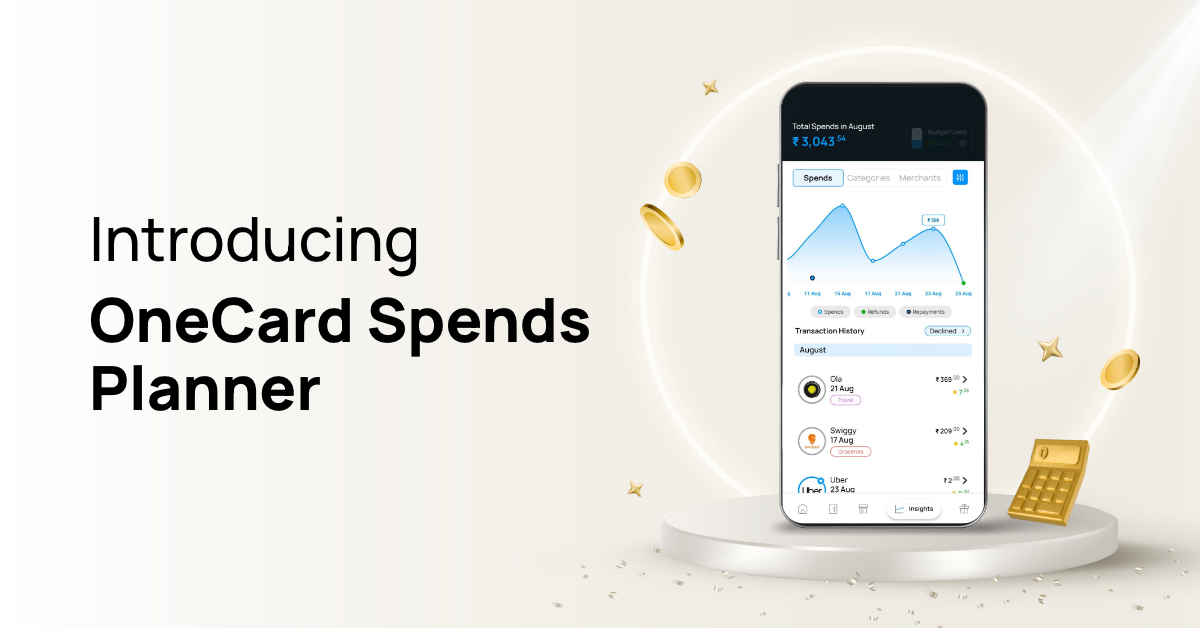

2. Maintain a healthy credit utilisation ratio

A credit utilisation ratio is the ratio of credit used to available credit. For example, if you have a credit limit of Rs. 50,000 and you have used a credit of Rs. 25,000, then your credit utilisation ratio will be 50%. For a healthy credit score, it is recommended to keep the credit utilisation ratio below 30%. To keep a check on your credit profile, you can download the OneScore app, which gives information about all of your credit accounts, including your loans and credit cards.

3. Avoid debt trap

When it comes to using credit cards, using them carefully is very important. Credit cards are meant to add convenience to our lives. If you spend more than you can repay on time, you will start missing your due dates. This will lead to late payments and the associated charges, which can quickly go out of control.

What are the charges associated with FD backed OneCard?

1. FD closure charges

In case you close the fixed deposit before the completion of 12 months, there will be a tenure-based penalty of 1% of the interest earned on the fixed deposit.

2. Card closure charges

If you close your OneCard within 6 months of activating your virtual card, the following charges will apply:

- INR 3000 if it’s a metal OneCard

- INR 500 if it’s a plastic OneCard

Final Words

Getting an FD backed OneCard is one of the best ways to start enjoying the perks of credit cards and, at the same time, get an opportunity to work on your credit score. Applying for one is also easy, as it is a completely digital process. Click here to get started.

*FD interest rates may vary with time. Please check your OneCard app for the latest information.

**Disclaimer: The information provided in this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Technologies Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader for making any decision based on the contents and information. Please consult your advisor before making any decision.

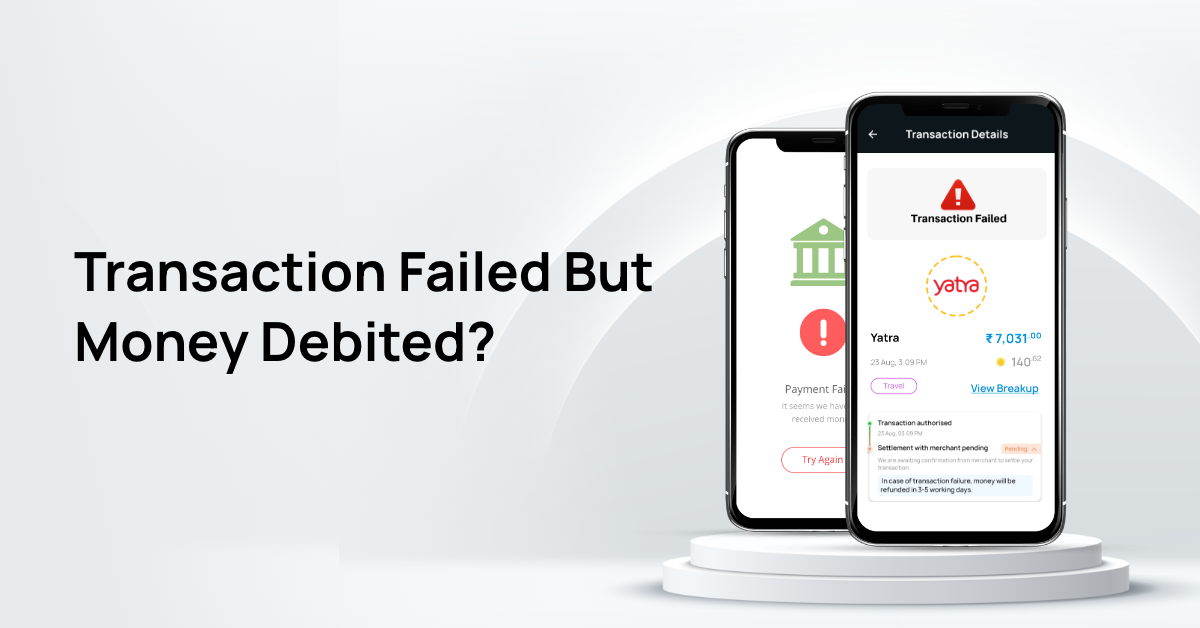

Credit Card Transaction Failed: Money Debited? Here's What To Do

Sharing is caring 😉